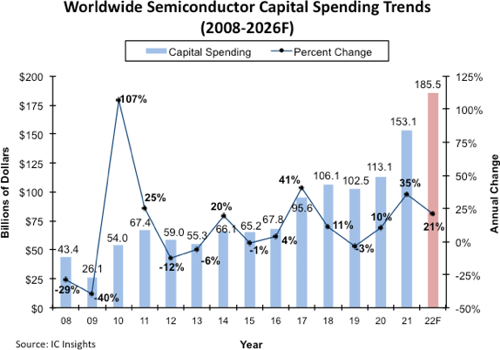

The revised outlook, which was included in IC Insights’ recently released August 3Q Update to The McClean Report, represents a decrease from $190.4 billion and 24% growth that was forecast at the beginning of this year.

Though lowered, however, the revised capex forecast still represents a new record high level of spending. In fact, if industry capital spending rises as forecast by a double-digit amount this year, it will mark the first three-year period of double-digit capital expenditure gains in the semiconductor industry since 1993-1995.

Wafer fab utilisation rates at many integrated device manufacturers (IDMs) remained well above 90% through the first half of this year and many semiconductor foundries operated at 100% utilisation rates, as orders remained robust during the economic recovery from the Covid-19 pandemic.

Combined two-year semiconductor capital spending in 2021 and 2022 is now expected to reach $338.6 billion.

IDMs and foundries are spending heavily on new manufacturing capacity for logic and memory devices built with leading-edge process technology. However, strong demand and ongoing shortages of many other essential chips such as power semiconductors, analogue ICs, and various MCUs, have caused suppliers to boost manufacturing capacity for those products as well.

IC Insights does suggest that concerns are growing over soaring inflation, however, and a rapidly decelerating worldwide economy that has caused semiconductor manufacturers to re-evaluate their aggressive expansion plans at the mid-point of the year.

Several suppliers - particularly many leading DRAM and flash memory manufacturers - have already announced reductions in their capex budgets for this year. Many more suppliers have noted that capital spending cuts are expected in 2023 as the industry digests three years of robust spending and evaluates capacity needs in the face of slowing economic growth.