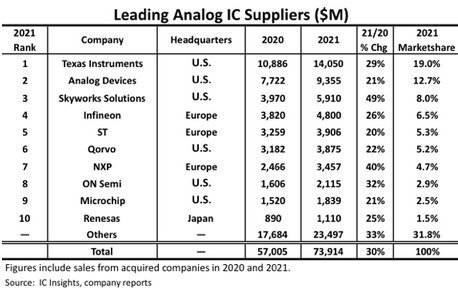

TI’s 2021 analogue sales rose $3.2 billion or 29% compared to 2020, according to IC Insights’ 2Q22 Update to The McClean Report, with analogue revenues accounting for 86% of its $16.3 billion in IC sales and 81% of its $17.3 billion in semiconductor revenue.

IC Insights’ top 10 ranking includes sales of general-purpose analogue components, mixed-signal analogue, and application-specific analogue devices that have at least 50% analogue circuitry on board. As shown below, the ranking of top suppliers remained unchanged in 2021 compared to 2020.

Six of the top 10 analogue companies are based in the US, three are headquartered in Europe, and one is based in Japan. Collectively, the top 10 accounted for $50.4 billion in analogue IC sales last year, which represented 68% of the total analogue market.

Among the top 10 analogue companies, sales growth ranged from 20% at ST to 49% at Skyworks Solutions.

Second-ranked Analog Devices (ADI) saw its 2021 analogue IC sales increase 21% to $9.4 billion, which represented 13% marketshare. ADI, which completed its $28.0 billion acquisition of Maxim Integrated products in August 2021, said its analogue devices sales by end-use application were industrial (50%), automotive (21%), communication (15%), and consumer (14%).

Ranked third in 2021 with sales of $5.9 billion was Skyworks Solutions, whose 49% jump in revenue was the largest percentage increase among the top suppliers last year. Skyworks is focused on front-end modules and power amplifiers for handsets and smartphones, highly integrated SiP and SoC devices for wireless infrastructure, power management chips, precision analogue components, WiFi connectivity modules and ICs, and smart energy ICs for ZigBee and Bluetooth applications.

Skyworks’ largest customer in 2021 was Apple, which accounted for 59% of its sales.

In July 2021, Skyworks acquired the Infrastructure and Automotive business of Silicon Laboratories in a deal worth $2.75 billion, and which was described as helping to accelerate its expansion into electric and hybrid vehicles, industrial and motor control, 5G wireless infrastructure, optical data communication, data centre, and other applications.

Each of Europe’s three major IC suppliers - Infineon, ST, and NXP - was a top 10 analogue supplier in 2021. Collectively, the three companies accounted for 16% of global marketshare. Fourth ranked Infineon was the highest placed European analogue supplier with sales of $4.8 billion.

The analogue market typically grows (and declines) at a more tempered rate than the total IC market, but that was not the case in 2021 when it grew by 30%, while the total IC market increased 26%.

Every general purpose and application specific analogue product segment enjoyed double-digit sales growth in 2021. Signal conversion revenue grew 13% last year, but revenue in every other analogue IC category jumped by at least 27%.