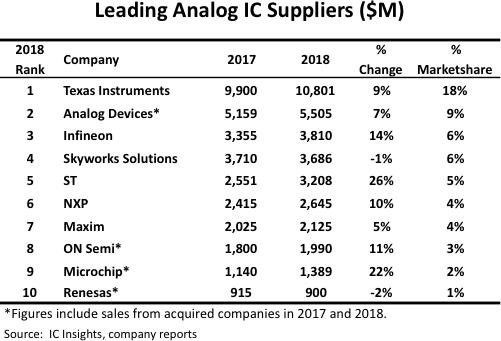

With analogue sales of $10.8bn and 18% marketshare, Texas Instruments (TI) maintained its firm grip as the world’s leading supplier of analogue devices, says IC Insights.

TI’s 2018 analogue sales increased $0.9bn and were nearly twice those of second-ranked Analog Devices (ADI) and more than 10x those of tenth-ranked Renesas, one of two companies among the top 10 to experience a decline in analogue sales, says IC Insights. TI’s 2018 analogue revenue accounted for 78% of its $13.9bn in IC sales and 72% of its $14.9bn total semiconductor revenue.

TI primarily targets industrial applications (36% of 2018 revenue), personal electronics (23% of 2018 revenue), and automotive applications (20% of revenue) with its analog products. It is worth noting that industrial and automotive applications represented 56% of TI’s revenue in 2018, up from 42% just five years ago.

Maintaining second place in the analogue ranking was ADI, which registered a 7% increase in analog IC sales to $5.5bn in 2018. Revenue numbers shown for ADI include sales from Linear Technology, which ADI acquired in 1Q17 for $15.8bn in cash and stock. No single customer accounted for more than 10% of ADI’s 2018 sales. More recently, ADI’s largest customer was Apple, which accounted for 14% and 12% of total revenue in 2017 and 2016, respectively.

Each of Europe’s three major IC suppliers was a top-10 analogue supplier in 2018, states IC Insights. Collectively, the three companies accounted for 15% of global analog marketshare. Climbing up one position into third place was Infineon, which grew its analogue sales 14% to $3.8bn and accounted for 6% marketshare. Infineon continues to expand its presence in automotive (43% of 2018 sales) and power management (31% of 2018 sales) applications. Industrial power control (17%) and chip card and security (9%) rounded out its other major end-use applications.

ST’s analogue sales jumped 26%—highest among the top 10 analogue suppliers—to $3.2bn (5% marketshare). Much of ST’s analog IC sales target motion control (motor driver ICs and high-voltage driver ICs), automation (intelligent power switches), and energy management (powerline communication ICs) applications.

NXP was the sixth-largest analogue supplier in 2018 with sales that increased 10% to $2.6bn (4% marketshare). NXP sells its analogue devices into many system functions but one of its key growth areas is automotive, where its analogue chips are essential components in emerging LiDAR, vehicle network, and 5G systems.

Analogue sales at ON Semiconductor increased 11% to $2.0bn, which represented 3% share of the market, IC Insights adds. ON’s 11% increase followed analogue sales gains of 35% in 2017 and a 16% rise in 2016.

Three years of strong analogue sales gains at ON were partly the result of its acquisition of Fairchild Semiconductor in September 2016, and partly due to strong sales of power management products into the automotive market, specifically for active safety, powertrain, body electronics, and lighting applications.

Analog IC sales at Microchip Technology increased 22% in 2018. In May 2018, Microchip completed its $8.35bn acquisition of Microsemi, which gave a boost to the company’s analogue business in computing and communications applications, IC Insights says.