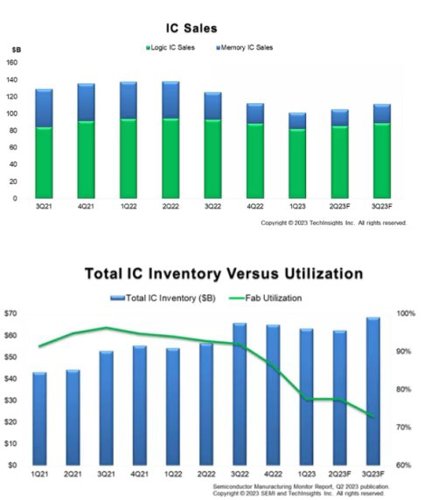

Working in partnership with TechInsights, and reported in the Semiconductor Manufacturing Monitor, Q3 2023 electronics sales are projected to post healthy quarter-on-quarter growth of 10%, while memory IC sales are expected to log double-digit growth for the first time since the downturn started in Q3 2022. Logic IC sales are predicted to remain stable and improve as demand gradually recovers.

Despite signs of a recovery headwinds will continue for the semiconductor manufacturing sector in the second half of the year, according to SEMI and TechInsights.

Drawdowns of high inventory at integrated device manufacturer (IDM) and fabless companies will continue to suppress fab utilisation rates to much lower levels than those in the first half of 2023 and this weakness is projected to extend declines in capital equipment billings and silicon shipments for the rest of the year despite stable results in the first half of 2023.

Market indicators point to a semiconductor industry bottoming at the end of the first half of 2023, and the industry has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-over-year increases in 2024, with electronics sales surpassing its 2022 peak.

“The slower-than-expected demand recovery will delay the normalisation of inventory until the end of 2023, later than we previously anticipated, leading to additional reductions in fab utilisation rates in the short term,” said Clark Tseng, Senior Director of Market Intelligence at SEMI. “However, recent trends suggest that the worst is over for ICs. We anticipate semiconductor manufacturing will bottom in Q1 2024.”

“While semiconductor markets have seen a sharp downturn the last four quarters, equipment sales and fab construction have been performing much better than expected,” said Boris Metodiev, Director of Market Analysis at TechInsights. “Government incentives have been driving new fab projects and strong backlogs have helped equipment sales.”