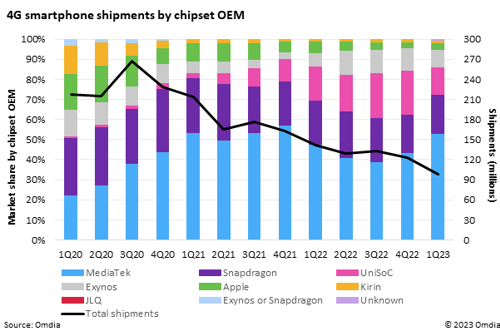

According to Aaron West, Senior Analyst in Omdia’s Consumer Electronics practice, Mediatek leads a declining 4G smartphone chipset market with 53% share of smartphone shipments compared to Snapdragon’s 19% and Unisoc’s 14%.

Captain of a sinking ship? With smartphone OEMs switching to 5G chipsets, the 4G smartphone market is in decline and has shrunk 30% year-on-year, from 141 million in 1Q22 to 99 million in 1Q23.

While that’s a dramatic market decline, market shares of each supplier have remained largely consistent over the past two years, with the entrance of Unisoc being the only major shift in the market.

MediaTek’s main competitor is Qualcomm’s Snapdragon, who supplies 4G chips for many of the same smartphone OEMs as MediaTek. Xiaomi and Samsung are the biggest clients for MediaTek, while Snapdragon’s biggest two are Huawei and Xiaomi.

According to West, UniSoC has been hit hardest by the slump in Chinese OEMs.

UniSoC two years ago was a minor chip maker, who primarily only made chips for Transsion brands Infinix, iTel and Tecno, and ZTE. But throughout 2021, a growing number of brands including the likes of Motorola and Samsung switched to the company’s chipsets for their low to mid-end phones. The chipmaker’s market share for 4G phones grew from 3% in 1Q21 to 17% in 1Q22, peaking as the second biggest supplier of 4G chips in 3Q22 and 4Q22, with 22% market share, slightly edging out Snapdragon.

However, UniSoC is now feeling the effects of negative headwinds impacting the market. Due to cost-of-living constraints, consumers who typically purchase low-end phones are delaying their next purchase.

As the major supplier of 4G chips for Realme, UniSoc has also faced challenges due to the tough domestic market conditions in both China and India which have impacted Realme’s shipments. In 1Q23, UniSoC saw its shipments fall 43% year-on-year. Although 30% of all 4G chip shipments fell in that period, a key observation is that UniSoC’s market share experienced a steep decline, from 17% to 14%, as other chipmaker shares grew.

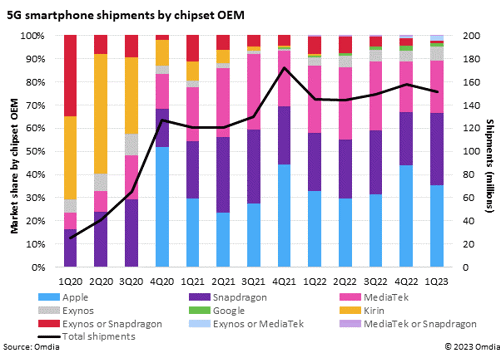

In 1Q23, shipments of smartphones with 5G Snapdragon chips accounted for 31% of all 5G smartphones, up from 25% in 1Q22, although less than its peak at 33% in 2Q21. This recovery of lost 5G chipset market share is largely a result of Samsung switching to Qualcomm’s Snapdragon in its Galaxy S23 series, which shipped a total of 11.8 million units in just 1Q23 alone.

Honor has also primarily used Snapdragon chips for its flagship devices since 2021.

Google’s switch from using 5G Snapdragon chipsets on its Pixel phones to using proprietary Google Tensor chips from the Pixel 6 onwards didn’t particularly influence Snapdragon’s market share at the time as Pixel phones made up such a small part of the market.

However, as West points out, if Google continues to grow in the high-end smartphone market, which in turn reduces the market share of Samsung and others, then Snapdragon could in turn feel the squeeze.

In 2020, Kirin supplied 66.2 million 5G chipsets for Huawei smartphones, accounting for 26% of the total 5G smartphone chipset market that year. But since the US has placed sanctions against Huawei’s 5G business, Omdia’s data has seen the brand’s shipments collapse. In 2022, it supplied just 1.3 million, less than 1% of the total market.

Even as Huawei is now recovering its smartphone business, it has taken a step-away from the Kirin brand, choosing instead to transition to using primarily Snapdragon 4G chipsets.

Turning to Apple, its unsurprising that Apple’s 5G chipsets make up most 5G chipsets in the smartphone market, given it is the second largest smartphone OEM and it mostly manufactures 5G phones. It has been the largest 5G chipset maker every quarter since 4Q21 and, with the launch of the iPhone 14s in 4Q22, its 5G chipsets accounted for 44% of shipments in that quarter.

With Apple’s commitment to making its own chips, and with its strong performance even in a declining market, it’s likely Apple’s 5G chips will keep the largest share for some time to come.