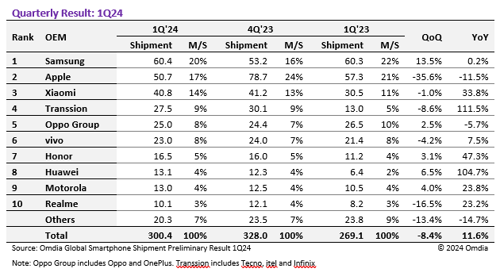

In 1Q24 total shipments reached 300.4 million units which represents an 11.6% increase compared to 1Q23 and marks the second consecutive quarter of year-on-year increase after a prolonged period of market stagnation and decline over the past two years.

These figures would suggest that overall smartphone shipments are beginning to stabilise after a period of considerable turbulence, which were exacerbated by supply chain problems in 2022.

Most OEMs recorded large double-digit year-on-year growth, including Xiaomi, Honor, Motorola, and Realme, with Transsion and Huawei – all of whom saw triple-digit growth.

By contrast, both Apple and OPPO saw a year-on-year decline.

Samsung recorded the most shipments of any OEM in 1Q24, with 60.4 million units. With the launch of the latest S24 series flagship phones including Galaxy AI features it recorded growth of 13.5% from 4Q23.

Demand for mid- to low-priced smartphones, which account for a large portion of Samsung's total smartphone shipments, continues to recover but overall shipments have remained at a similar level to last year due to intensifying competition with Chinese companies.

Apple is certainly interesting. It shipments in 4Q23, following the launch of the iPhone 15 series, surged but in 1Q24 total sales decreased to 50.7 million units – marking a decline compared to the previous year.

Why? That fall is being attributed to delayed production and shipments from 4Q22 to 1Q23, resulting in higher-than-usual shipment totals. Given the successful performance in 4Q23 for Apple, the decline in 1Q24 was neither unexpected or alarming, according to Omdia.

“China is an important market for Apple with the second largest shipment volume after the United States. However, Apple has been facing intense competition from Huawei in the premium segment of the Chinese local market since the second half of last year, which has contributed to disappointing iPhone shipments in the first quarter. Performance in the Chinese market will be an important factor in determining Apple’s overall shipments this year,” said Jusy Hong, Senior Research Manager in Omdia’s Smartphone group.

Xiaomi shipment figures have fallen marginally from the previous quarter; with 40.8-million-unit shipments in 1Q24. This is a slight 1% dip from the 41.2 million in 4Q23, which was also a slight fall from the 41.8 million in 3Q23. But it is still a notable 33.8% increase year-on-year, from 1Q23. Despite the reducing quarter-on-quarter shipment figures, Xiaomi still shows signs that it is recovering. This trend follows a prolonged period of declining market share, even amidst an overall decrease in the smartphone market.

Transsion’s shipments have fallen slightly following successive quarters of growth, from 30.1 million in 4Q23 to 27.5 million in 1Q24, an 8.6% fall. But, as this is only a slight decline after a period of very strong growth, Transsion is still in triple-digit growth compared to one year ago, where it recorded 13 million shipments in 1Q23. Transsion’s shipments have more-than-doubled over the past year, propelling it to go from the sixth largest to the fourth largest OEM. It has overtaken both vivo and Oppo, now leading them by 2.5 million units per quarter.

Oppo Group, which is the Oppo and OnePlus brands, recorded 25 million shipments in 1Q24, a 2.5% growth from the previous quarter but a 5.7% fall compared to 1Q23. As Oppo Group contends with increasing competition from Transsion and grapples with a declining market size throughout 2023, these factors collectively contributed to the long-term trend of Oppo declining.

Over 2024, it will be a key goal of Oppo to simply maintain its position, as Transsion pulls further ahead.

Oppo will also have to contend with vivo, which has begun recovering shipments after experiencing a large fall between 1Q22 and 4Q23. In 1Q24, there were 23.0 million vivo smartphone shipments, up from 21.4 million in the past year, an increase of 7.5%. While it is a 1 million unit decline from the previous quarter, where it recorded 24.0 million units in 4Q23, this was expected as the fourth quarter is typically the largest quarter.

Honor remains the seventh largest OEM globally, but is continuing to grow, going from strength-to-strength. In 1Q24, Honor recorded 16.5 million unit shipments, a large 47.3% increase from the 11.2 million units in 1Q23. Although Honor is facing a challenge from Huawei in the Chinese domestic market, it has been able to increase overall shipments due to increased overseas volumes.

Rising from ninth to eighth position in Omdia’s research, Huawei maintained the strong momentum it built owing to the Mate 60 Pro launch in the second half of 2023. Just like Honor, Huawei recorded successive quarter-on-quarter growth throughout 2023, increasing from 6.4 million units in 1Q23 to 12.3 million units in 4Q23. Now, in 1Q24, it reached 13.1 million units, meaning it doubled its shipments year-on-year.

Closely trailing Huawei is Motorola, who recorded 13.0 million units, growing quarter-on-quarter and year-on-year, just like Huawei, although to a lesser degree. Motorola is up 4% from 12.3 million in 4Q23 and up 23.8% from 10.5 million in 1Q23. This continued growth means that Motorola is exceeding expectations.

Remaining in tenth position, having fallen from eighth over 2023, is Realme. It recorded year-on-year increases in shipments again in 1Q24, with 10.1 million units, up from 8.2 million in 1Q23. While Realme’s shipments have declined from the previous quarter, down 16.5% from 12.1 million units in 4Q23, the brand has encountered the worst decline throughout 2023 than any other major smartphone OEM. Realme is facing an uphill struggle, especially as demand for low-end priced smartphones has declined.

“The most noticeable trend in the smartphone market is the polarisation of smartphones to low-end and premiums smartphones. This has disproportionately benefited Apple and Huawei, while brands focusing on mid-priced phones, such as Samsung, Oppo and Realme have faced challenges. As we move through 2024, the global market is expected to grow year-on-year, particularly in the first half. However, these dynamics will persist in determining which OEMs will benefit the most from this growth,” concluded Hong.