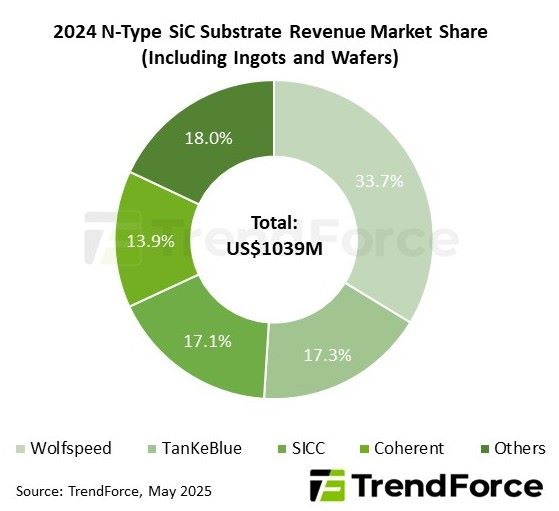

In addition, intensifying market competition and sharp price declines pushed global revenue for N-type SiC substrates down 9% YoY to $1.04 billion.

Looking ahead to 2025, the SiC substrate market is expected to continue to face the dual pressures of soft demand and oversupply. Despite that, long-term growth prospects remain promising, according to TrendForce.

As production costs gradually decline and semiconductor device technology advances, SiC applications are expected to expand - particularly in diverse industrial segments. Moreover, heightened competition is accelerating industry consolidation and reshaping the market landscape.

Wolfspeed has maintained its position as the top supplier in 2024 with a 33.7% market share, despite ongoing operational challenges. The company remains a key force in the SiC materials market and continues to lead the industry’s transition to 8-inch wafers.

TanKeBlue and SICC, the Chinese vendors, have rapidly emerged as major players, claiming 17.3% and 17.1% market shares respectively, placing them in second and third place. TanKeBlue is the largest domestic SiC substrate supplier for China’s power electronics market, while SICC leads in the 8-inch SiC wafer segment.

Coherent, by contrast, dropped to fourth place with a share of 13.9%.

Although 6-inch SiC substrates will remain dominant in the near term - due to their steep price declines and the technical challenges of scaling 8-inch front-end processes - 8-inch wafers are seen as essential for further cost reduction and advancing chip performance. This is driving aggressive investment across the industry.

TrendForce is forecasting that 8-inch SiC substrates will account for over 20% of total shipments by 2030, signalling a pivotal shift in the technology roadmap.