The weak global economy is forecast to slow first-time and replacement purchases of smartwatches and fitness trackers, as rising food and energy prices force people to cut spending on non-essential items. This is the key finding of the latest market forecast published by technology analyst firm CCS Insight.

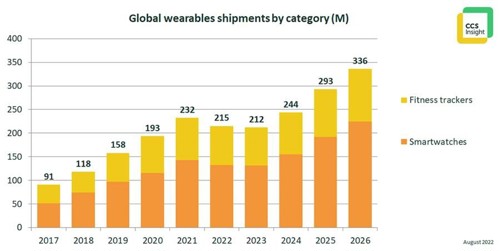

According to the report, a total of 215 million smartwatches and fitness trackers are forecast to be sold worldwide in 2022, down from 232 million in 2021.

"The effects of inflation and squeezed budgets have taken a toll on the wearables market throughout 2022 so far", noted James Manning Smith, Senior Analyst. "With economic difficulties expected to persist in the final quarter of the year, typically the strongest period for wearables sales, even the holiday season is expected to deliver weak demand for wearables".

Worldwide, rates of new adoption and product replacement have slowed during the year as inflation and other economic factors have curbed people's ability to buy wearables. Although total ownership is still on an upward trajectory, many people are now thinking twice about purchasing new products. Demand from existing users has also borne the brunt of the difficult economic climate, as they choose to keep devices for longer, waiting to replace them until their spending power improves.

The economy in 2022 is expected to slow purchases by new customers, but the overall number of wearables users will continue to expand, aided by launches of new products.

"The imminent launch of Google's Pixel Watch is a development we are watching closely, with the company's investment in smartwatch hardware signalling a renewed commitment to wearables", added Manning Smith. "We expect the Pixel Watch launch to promote additional investment in smartwatches powered by Google's Wear OS, which should drive adoption from Android smartphone users".

The outlook for the wearables market remains poor for 2023, with shipments of smartwatches falling by a further 1% and fitness trackers by 2%. A further contraction of demand for both categories is expected as economic trouble lingers throughout the year, with replacement and new adoption purchases falling further.

Despite a negative short-term outlook, CCS Insight expects some recovery in 2024 as the economic picture improves. From 2024, the smartwatch market is expected to return to growth, leading to sales of 224 million units in 2026. Advanced economies are forecast to maintain a strong lead in smartwatch adoption rates, but as low-cost smartwatches and developments in Wear OS devices provide more options for Android users, smartwatch demand in developing countries is set to blossom.

Fitness trackers played an important role in establishing demand for wearable technology, but the outlook for the product category has become less positive.

"Although the fitness tracker segment is forecast to remain healthy worldwide, we expect many consumers in developed countries to gradually shift to smartwatches", added Manning Smith. "This will result in a declining market for fitness trackers in North America, Western Europe and developed markets of Asia–Pacific". However, powered by sales in developing countries, fitness tracker shipments are projected to return to growth in 2024, reaching sales of 112 million in 2026.

Although 2022 and 2023 are not shaping up to be positive years for the wearables industry, CCS Insight expects a return to strong growth in ownership moving forward.

By 2026, the number of wearables owners is set to double from 2021, reaching close to 1.2 billion. As this pool of users continues to grow, the technology industry has a huge opportunity to make steady investment in new services targeting the digital consumer.