According to IC Insights’ updated second-quarter semiconductor forecast, MCU sales are expected to increase by 12% to a record-high $114.8 billion this year, benefiting from higher average selling prices (ASPs).

Total MPU sales grew 13% in 2021 and climbed 16% in 2020, when the Covid-19 drove demand for more personal computers, smartphones, and Internet connections.

IC Insights’ 2Q Update to the 2022 McClean Report service shows total MPU shipments rising just 3% this year, which will lift unit volume to an all-time high of nearly 2.5 million processors following increases of 6% in 2021 and 5% in 2020. MPU revenues in 2022 are expected to get a boost from an 8% increase in ASPs after average prices grew 7% last year and 10% in 2020, says IC Insights’ 2Q Update.

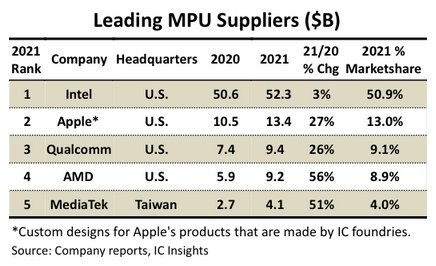

The figure below shows that the ranking of the top five microprocessor suppliers was unchanged in 2021 compared to 2020, with their combined revenue values of MPUs shipped last year rising 15% to $88.3 billion.

The combined 2021 marketshare of the five largest microprocessor suppliers reached 86.0% of the world’s total $102.7 billion MPU sales last year compared to 85.0% in 2020 and 82.1% in 2016. The next five largest MPU suppliers (Nvidia, Samsung, UNISOC, HiSilicon, and NXP) collectively held a 4.3% share of the 2021 total (or $4.4 billion) versus 5.0% in 2020.

IC Insights’ MPU ranking is based on sales of computer CPUs, embedded microprocessors, and mobile phone application processors but excludes co-processors, such as AI/machine-learning accelerators and standalone graphics processing units (GPUs).

Many application-specific system-on-chip (SoC) designs with integrated CPU cores are also not counted in the MPU ranking.

Top-ranked Intel and fourth-place Advanced Micro Devices supply processors built with the x86 microarchitecture for traditional personal computers running Windows operating system software from Microsoft, inexpensive Chromebooks backed by Google, some tablets, and the vast majority of servers used worldwide. Intel and AMD also sell x86 designs for embedded MPU applications.

The rest of the top five MPU suppliers sell mobile designs and embedded system-on-chip (SoC) microprocessors containing RISC architectures and CPU design cores licensed from the UK-based ARM subsidiary of Japan’s SoftBank holding company.

IC Insights estimates that Intel’s 2021 microprocessor revenues grew just 3% to $52.3 billion, which was 50.9% of the total MPU market last year, compared to a 55.7% share in 2020 and 58.4% in 2016. Rival x86-processor supplier AMD saw its MPU sales surge 56% to $9.2 billion in 2021, grabbing revenue away from Intel and moving up its total microprocessor marketshare to 8.9% last year compared to 6.5% in 2020 and 3.3% in 2016 prior to the company’s dramatic turnaround in CPUs for PCs and server computers in the past five years.