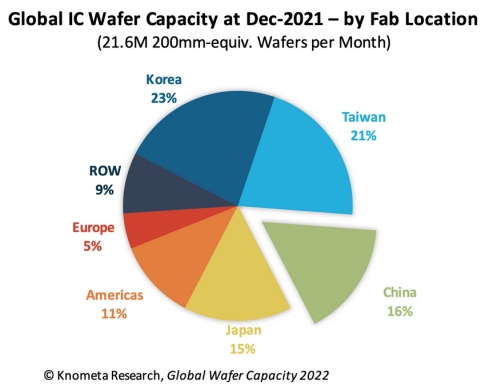

The country ended the year having 16% of global capacity, based on normalised installed monthly capacity amounts.

Worldwide IC wafer capacity at the end of 2021 was 21.6 million 200mm-equivalent wafers per month, with fabs in China having the capacity to process 3.5 million.

China’s share of capacity has increased one percentage point in each of the last two years and a total of seven points since 2011, when the country accounted for just 9% of all IC wafer capacity.

The report published by the SIA and Boston Consulting Group showed that the cost of building and operating a fab in China is lower than in any other nation. As a result, fab capacity is expanding faster in China than anywhere else.

Roughly half of all IC wafer capacity in China is controlled by foreign companies. In fact, some of the largest fabs in the country are owned by SK Hynix, Samsung, TSMC, and UMC. SK Hynix alone controls 17% of China’s capacity, and that does not count Intel’s NAND flash fab in Dalian that SK Hynix is in the process of acquiring. Ownership of the fab was transferred to SK Hynix in December 2021, but Intel will continue to run it until March 2025.

As projected in Global Wafer Capacity 2022, China’s share of global IC wafer capacity is expected to reach nearly 19% by 2024. While SK Hynix, TSMC, and UMC are expanding their existing fabs in China, most of the new fabs under construction in the country are owned by domestic entities.