For most of the 20th Century, batteries were an overlooked technology. And for good reason; the available batteries – predominantly lead-acid, although disposable zinc-carbon cells were also popular – were entirely suitable for the applications of the time. There was no particular reason to push the technology forwards.

But times changed. As the Century drew to a close, portable battery powered consumer electronics devices became widely used. Consumers not only wanted their products to last longer between either installing new batteries or recharging them, but a trend for smaller devices also appeared.

Now, electric and hybrid vehicles have added another twist. Together, these elements have kick started the recent interest in finding new battery technologies and chemistries.

Energy storage was one of the areas selected by ex industry minister David Willetts as one of the Eight Great Technologies. In a paper published in 2013, Willetts noted: “We need better ways to store electricity. This need arises at three distinct levels. First, there are the batteries in all our personal electronic devices. The second level is the development of better energy storage for vehicles. Thirdly, there is the challenge of storing more electricity for the Grid.”

Looking to take advantage of the opportunities, the Government is providing significant funding – as part of its Industrial Strategy – to help UK organisations to get the jump on other countries. Business and Energy Secretary Greg Clark announced in July 2017 the launch of the first phase of a £246million investment into battery technology designed to ensure the UK builds on its strengths and leads the world in the design, development and manufacture of electric batteries.

Known as the Faraday Challenge, the four year investment will feature a coordinated programme of competitions, delivered via Innovate UK, that aims to boost the research and development of battery technology.

Anna Wise, batteries innovation lead at Innovate UK, told New Electronics: “The Faraday Challenge will provide an exciting opportunity to rebuild technology that has been developed in the UK. From the start,” she continued, “we’ll be looking at how we can invest at seven stages of technology readiness; looking to accelerate work that is close to market, as well as longer term projects.”

Towards the end of 2017, a partnership between Warwick Manufacturing Group (WMG), Coventry and Warwickshire Local Enterprise Partnership and Coventry City Council was awarded £80m to establish a National Battery Manufacturing Development Facility (NBMDF).

The NBMDF is intended to enable UK based companies and researchers to come together to build and maintain a world leading position in manufacturing technologies for batteries and their components in vehicles and transportation. It will provide a strategic link between the research, development and full-scale industrialisation for battery technologies across the UK. The facility will enable the development of the next generation of battery systems across battery chemistry, electrodes, cell design, module and pack levels.

Greg Clark, Business, Energy and Industrial Strategy Secretary, said at the launch: “Battery technology is … one of the cornerstones of our ambition, through the Industrial Strategy and the Faraday Challenge, to ensure that the UK leads the world and reaps the economic benefits in the global transition to a low carbon economy.”

Dr Emma Kendrick, a materials chemist and energy storage technical specialist at WMG, provided attendees at last year’s Electronics Design Show Conference with an update on developments in the field. “If you look at the rechargeable battery market, lead-acid is still the biggest technology, with NiCd and NiMH declining. But it’s a huge market, estimated to be worth $65billion and growing.”

When you consider the various market segments, it’s surprising to find the starter, lighter, ignition (SLI) sector in cars remains the largest of all markets and depends almost entirely on lead-acid batteries. “And lead-acid batteries will be around for a long time,” Dr Kendrick noted, “because it’s a massive market.”

It’s no surprise that demand for batteries in portable electronics product grew significantly since the 1990s, but more surprising perhaps is that demand has slowed somewhat. “The strongest growth in the rechargeable battery sector is now coming from the automotive and industrial sectors,” Dr Kendrick pointed out.

And it’s the electric vehicle (EV) market which the Faraday Challenge has at its heart. The Advanced Propulsion Centre, in association with the Automotive Council, has set some challenging targets for those developing batteries (see box).

“I’m not sure how realistic these targets are,” Dr Kendrick admitted. “If we are to get costs down and create 1400Wh/litre batteries, we can’t stick with what we have. New chemistries will be needed.”

One company looking to hit these targets is Nexeon, which has pioneered the development of silicon based materials for next generation Li-ion batteries.

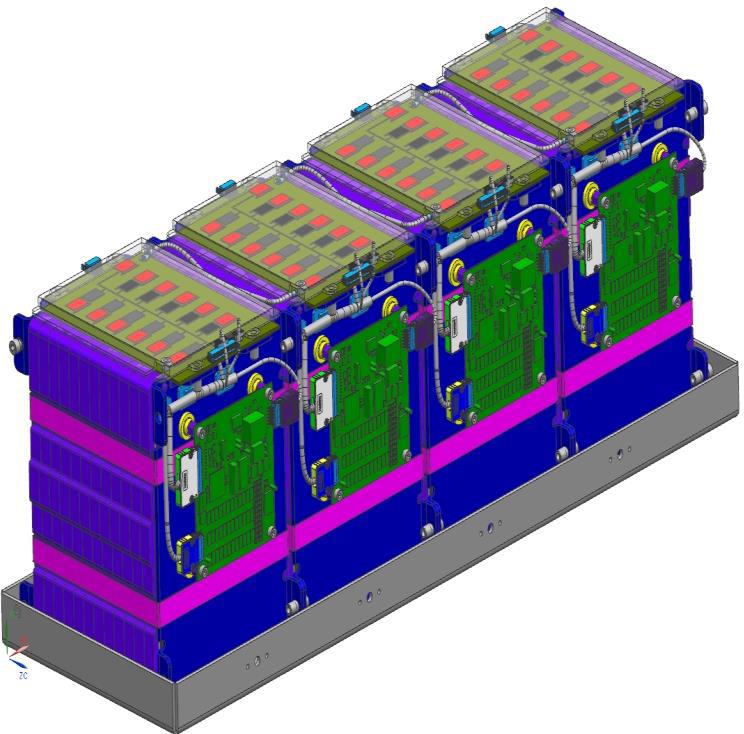

| Faradion's Na-ion cells have been used in this demonstrates developed by Williams Advanced Engineering |

It’s taking part in the £10m SUNRISE project (Synthomer, UCL and Nexeon’s Rapid Improvement in the Storage of Energy), which plans to develop better silicon based battery materials that can replace carbon in the cell anode, as well as optimising cell designs for automotive applications. According to the partners, their work will be ‘an essential step’ in the quest to provide EVs with a range of more than 400 miles. The work is also being seen as another way to enhance the UK’s position as a centre of excellence for battery development.

Nexeon will lead the silicon material development and scale-up stages of the project, while polymer specialist Synthomer will lead the development of a next generation polymer binder optimised to work with silicon. Meanwhile, Nexeon and University College London will work on material characterisation and cell performance.

Dr Bill Macklin is Nexeon’s chief engineer. He said SUNRISE will start as a TRL4 project – essentially lab based work. “But we’re aiming to be at TRL6 in three years.” To achieve that, the project partners will need to demonstrate prototype technology applied in the relevant sector.

Nexeon’s heritage is in the development of silicon anodes for use in Li-ion batteries. It did get to the point where it built a pilot production facility, but discovered the economics were more challenging than developing the technology.

“Since then,” Dr Macklin said, “we’ve been developing two families of alternative materials. One has 15% of silicon in graphite or another active material. In the other family, we’ve gone back to the lab to work on the original concept of high silicon load.

“It’s a continuum from no silicon all the way to a dominant amount of silicon. More silicon gives more capacity, which means smaller, lighter batteries. But this also brings challenges of cycle life and expansion.”

Silicon anodes, in theory, can store more lithium ions and hence, offer better power densities. But, as more lithium ions arrive at the anode, the distance between silicon atoms increases, causing the material to fracture. Dr Macklin accepts that battery technology will be driven by improved electrode designs. “As you put more silicon into an anode, expansion becomes critical.” This requires expansion mitigation and a potential solution is the use of a polymer developed by Synthomer. “Void space in the polymer can accommodate some of the silicon expansion,” he continued, “which means there is less impact at the cell level.”

SUNRISE also faces the economic challenges alluded to in the Automotive Council’s targets. “A key feature when you’re making these things in commercial quantities will be cost,” said Dr Macklin. “Graphite costs around $12 per kg. If silicon anodes give four times the capacity of graphite, that material has to sell for about $50/kg – and that’s not a trivial target.”

While SUNRISE is focused on automotive applications, Dr Macklin believes a logical progression would be to address the portable device market, where there’s an appetite for small batteries. “In this market, the requirements are less onerous,” he noted. “Our opportunities are far wider than automotive, even though forecasts suggest this could be the dominant market in the future. We’re trying to ensure that our materials are applicable to all battery formats because nobody can predict a winner. But there’s still work to be done in order to get silicon – even at low levels – adopted in pouch batteries,” he admitted.

One of the attractions of developing batteries for portable electronics devices, according to Dr Kendrick, is the focus isn’t on cost. “Users are far more interested in charging once a day or less and for the battery to last for as long as possible. So developers are targeting energy density.” She noted this application is being served by layered oxide materials. “These have some of the highest voltages you can get, as well as highest specific capacity.”

| Battery chemistries must be compatible with all formats according to Nexeon's Dr Bill Macklin |

However, she warned that every market needs a different battery technology. “One technology doesn’t fit all. Today, we see technologies developed for consumer electronics, for example, being shoehorned into other markets. We need to know what we are developing batteries for so we can meet the various targets, such as life, cost and energy density.”

Looking to the future, Dr Kendrick believes lithium-sulphur batteries are ‘quite interesting’. “They are being developed in the UK by Oxis,” she pointed out, “but still need more work. One issue is that soluble products dissolve into the electrolyte, which means efficiencies are relatively low. While Oxis has produced a demonstrator system, which is light and has a good Wh/litre figure, the Wh/kg is not so good because sulphur isn’t particularly dense.”

| “If we are to get costs down and create 1400Wh/litre batteries, we can’t stick with what we have. New chemistries will be needed.” Dr Emma Kendrick |

Lithium-air was flagged by Dr Kendrick as another interesting technology. “It should have one of the highest energy densities as lithium is light, plus it draws oxygen from the air. In theory, it should have the best volumetric and energy densities, but it needs a catalyst layer and the volume of air needed is large, compared to the size of a standard Li-ion battery.”

There are also contamination problems caused by water vapour and CO2 in the air used by the battery. “This reduces the effectiveness, so both need to be scrubbed from the air before it’s used.”

Lithium-air was the underlying concept in the Battery 500 project developed by IBM, but this has been shelved because commercialisation was seen to be too long.

Sodium-ion batteries may also come to market. “UK company Faradion has developed a ‘drop in’ technology which used the same production techniques as Li-ion,” she said. “Material costs should be lower as sodium is the fourth most abundant element. But while the materials discovery phase is often shortest, it’s the scale up aspects that take time and resources.”

Automotive Council targets for 2035

|