In the last 100 years carmakers have innovated to perfect thermal engine propulsion systems, establishing a strong supply chain encompassing every corner of the planet. Accounting for changes to emission regulations they have tackled a requirement to reduce emissions by using better fuels, better engine controls, and better after-treatment components. However, this is not sufficient to realise zero emissions propulsion and carmakers are now migrating their fleets to be fully electric.

This technology has been present for quite some time, but the appetite for mass adoption has only been realised more recently. For examples, in the late 90s companies like Toyota deployed a hybrid electric vehicle on the road that clearly demonstrated the advantages of electric propulsion.

The Prius launched in 1997 with a nominal battery pack at 273V with a capacity of 1.78kWh, sufficient to get the car going but without the performance attributes of today’s hybrid electric vehicles due to the maturity levels of the technology. In those days, battery technology was still mostly Nickel-Metal-Hydride, with Li-Ion not featuring in vehicles until almost a decade later.

A concerted effort by governments over the next decade resulted in binding agreements to curb global warming by limiting the amount of man-made greenhouse emissions. Industries that were found to be the heaviest polluters were required to act more swiftly, this included road transport, which in 2022 accounted for 24% of the UK’s man-made greenhouse gas emissions (Department of Transport statistics 2022).

As a result, governments have increased their R&D support to new electric and alternative fuel propulsion technologies. One of the companies to benefit heavily from subsidies was start-up company Tesla in the USA. Despite the odds and scepticism within the automotive industry, Tesla released the first modern day Battery Electric Vehicle (BEV) in 2008. This platform had a 400V, 53kWh, Li-Ion battery pack and an IGBT 3-phase inverter powering an air-cooled induction motor.

Shortly afterwards Nissan released what was arguably the first mass market BEV in 2010, the Leaf. It featured a 400V, 24kWh, Li-Ion battery pack, an IGBT drive, and a permanent magnet synchronous motor (PMSM).

Since then, most major OEMs in Japan, Europe and USA have launched BEV lines. Tesla was once again a pioneer in releasing the first Silicon Carbide (SiC) drive in 2017 in their model Tesla 3. The power inverter was designed using pseudo-discrete devices from ST Microelectronics.

The correct approach?

In the last six years there have been many developments of SiC power modules for automotive applications. Nevertheless, the question remains of whether SiC technology is the correct approach to decarbonising road mobility when the cost of electric vehicles remains prohibitive for the mass market compared to thermal engine propulsion.

The passenger car market is divided into segments, with segment A corresponding to small vehicles with typical power around 50kW to 100kW, and progressively increasing in mass, size and power through segments B, C, D, and E to reach in excess of 300kW. The price of the vehicle increases with the vehicle size, whilst manufacturing volumes are the highest for segment A and lowest for segment E. Therefore, each of these segments will prioritise cost and performance differently. In segment A, the cost of parts is a very high priority, and it is therefore foreseeable that the higher cost of SiC technology compared to IGBT will limit their adoption until the cost of the two types of semiconductor becomes more comparable.

The superior performance of SiC power semiconductors over IGBTs is due to their wide bandgap properties, 3.26eV versus 1.12eV, resulting in a higher electric breakdown of 2.8E6 V/cm compared to 3E5V/cm. This translates to smaller geometries and as a consequence faster transition times and lower switching losses.

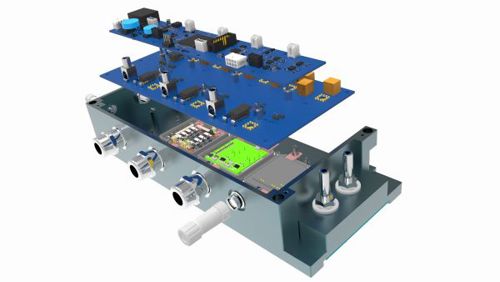

Above: An 800V/250kW Silicon Carbide Inverter

SiC technology also has superior thermal conductivity over silicon. This allows the transfer of more power for a give die geometry. There is one aspect of IGBTs that is superior to SiC MOSFETs. The bipolar construction of the IGBT results in a saturation voltage when fully turned on. This voltage is relatively constant with respect to the current flowing through the device. The conduction loss in the IGBT therefore increases linearly with the current. In contrast, SiC MOSFETs are field effect transistors with a bulk resistance when fully turned on. The conduction loss increases quadratically with the current. At high currents some IGBTs will have lower conduction losses compared to similarly sized SiC MOSFETs.

Ricardo has worked with SiC MOSFETs since 2019 with the introduction of our first generation of traction inverter. This was based on half-bridge power modules with a rating of 1.2kV and 660A that allowed the inverter to operate at continuous power level of 250kW. The design also featured a smart gate drive with diagnostics and protection features necessary to support high integrity levels expected from automotive products.

Fourth generation

The Silicon Carbide semiconductor market has grown significantly in the last 10 years. We are now in the 4th generation of devices. Every new generation brings new benefits in efficiency, packaging, and thermal transfer, although cost is still a challenge.

There are opportunities for new entrants to the traction inverter market to create a higher performance product, and challenges for companies that must continue to invest in new product generations every two years to stay ahead of the competition. However, not all new products are about high performance, often cost is the biggest driver. A new technology that can contend with the high performance of Silicon Carbide but at lower cost is Gallium Nitride (GaN) semiconductors.

GaN semiconductors have been widely used in radio frequency and opto-electronic applications for decades. It was not until recently that their properties were identified and targeted and power electronics conversion. Like SiC technology, GaN semiconductors are wide bandgap, 3.4eV versus 3.26eV, with very high electron mobility of 2000cm2/Vs compared to 1200cm2/Vs of SiC. All this means GaN devices are faster and can withstand higher voltages for the same geometry. In practice this translates to lower switching losses. A disadvantage of GaN is that its ON resistance is higher than SiC and features a steeper temperature coefficient, therefore conduction losses will be higher for the same geometry.

Another limitation of GaN transistors is that the lateral construction necessary to create the electron cloud channel for conduction needs to be relatively small to maintain high performance. Consequently, GaN devices cannot conduct large currents. This explains why their uptake has been slow and mostly around industrial and telecommunication power supplies of up to 1kW.

Above: The 400V/50kW GaN Inverter developed by Ricardo in collaboration with Nexperia

GaN technology has now been used in some automotive applications like On-Board-Chargers and DC/DC converters with power levels of around 4kW to 7kW. Operation at higher power levels requires paralleling devices.

There are several challenges to do this reliably compared with other semiconductor technologies. Due to their very fast transient performance, some devices in the parallel array may turn on earlier than the others and therefore conduct more current than the others. This may exceed their safe operating area limits and cause damage. In steady state, the positive temperature coefficient has a balancing and regulating effect. It is that crucial turn-on event that remains a key piece in achieving high power applications as required for traction inverters.

This is an area that Ricardo has spent many years researching and designing. Ricardo was the first company to design a 400V/50kW traction inverter in collaboration with Nexperia in 2020. This inverter featured four parallel devices to meet the power level and achieved peak efficiency of 98%. Since then, other companies have now achieved similar results, but the technology has not yet become mainstream. This is partly due to the lack of automotive qualification of devices and reliability concerns. As the technology matures, both aspects are expected to be resolved. As the cost of GaN semiconductors is comparable to that of silicon junction devices, this technology is also expected to be prevalent in the 50kW to 100kW traction inverter market.

In summary, each power semiconductor technology has advantages that appeal to different automotive segments. Improvements in new semiconductor generations result in efficiency gains and cost reduction that should make vehicles more affordable in the long run.

For mass EV penetration it is critical that segments A and B (small cars) become comparable in price to internal combustion engine vehicles and it’s here that GaN technology will make the biggest impact in driving cost reduction.

Ricardo have demonstrated how the technology can be used in traction applications of 50kW and are working towards a 100kW solution. It is now a matter of time before GaN semiconductor companies offer the reliability required by the automotive industry to allow mass deployment.

Author details: Dr. Temoc Rodriguez, Global Technical Expert Electric Propulsion at Ricardo