Semiconductors represent a critical technology essential for modern electronic products from digital communications to transport, healthcare and defence. Our reliance on semiconductors was brought into sharp focus with the recent shortage, which affected many automotive companies unable to complete production due to a lack of specific chips. These shortages highlight the fragile nature of complex global supply chains.

The recent publication of the Innovation Strategy by the government Department for Business Energy and Industrial Strategy (BEIS) stated, “Semiconductors have become an area of intense geopolitical interest. We will evaluate the nature of the support the government already gives the sector to support UK capabilities.”

So how does the UK rate in terms of its semiconductor capabilities? Firstly, semiconductors can be classified into 3 groups according to the materials they use: silicon semiconductors, compound semiconductors and organic semiconductors. Each semiconductor material lends itself to specific applications: silicon for artificial intelligence and computing, for example, compound for electric vehicles, renewable energy and quantum, while organic semiconductors are frequently used for displays and solar panels.

Silicon semiconductors represent the largest group by far, comprising around 70-80% of semiconductors within an electronic product.

The next largest group is compound semiconductors, which consist of two or more elements forming a semiconductor alloy. The most common alloys include gallium nitride (GaN) and silicon carbide (SiC). Typically, 10-20% of semiconductors in electronic products are compound semiconductors.

The final group is organic semiconductors. This group includes organic LEDs (OLEDs), which are used to make large area displays, and perovskites, which are used to make efficient solar panels. Recent technological advances by PragmatIC include a 32-bit microprocessor fabricated using flexible organic semiconductors, which could pave the way for new applications.

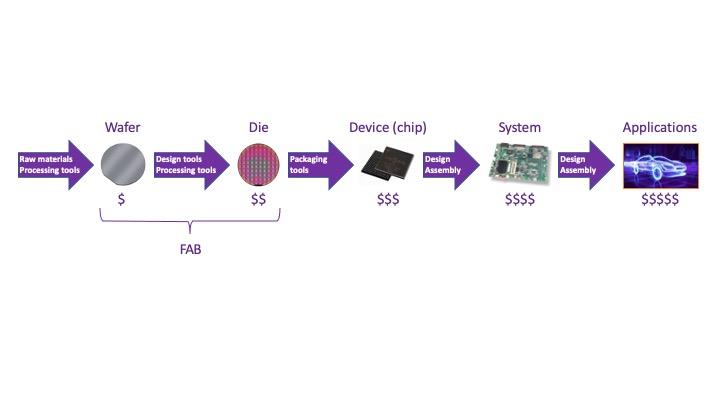

Semiconductor supply chains are complex, involving multiple processes and technologies delivered by specialist companies located around the world. A simplified representation of the supply chain is shown here.

Silicon semiconductors and compound semiconductors have similar supply chains, although they use different materials and processes to produce semiconductor devices, otherwise known as chips. Typically, the value of the product increases by 5x or 10x from one stage of the supply chain to the next. The early stages of the supply chain are referred to as fabrication, and these stages require large capital investments to create fabrication plants, known as fabs. Approximately 150 silicon fabs exist around the world, while there are far fewer compound semiconductor fabs.

UK capabilities

The UK has around 20 semiconductor fabs, ranging from low volume prototyping to high volume production, capable of producing over 1bn chips per year. Some UK fabs specialise in silicon chips, some specialise in compound semiconductor chips and some have mixed production.

Some fabs operate an ‘integrated device manufacturing’ (IDM) model; this means they conduct research into chip design and manufacturing processes, then manufacture and market their own chips. Other fabs operate an ‘open foundry’ model, which means they conduct research into manufacturing processes, but manufacture chips for third parties, rather than their own chip designs. Over the years, there’s been a trend for fabs to move towards an open foundry model, as this often provides greater utilisation.

A further complexity with silicon semiconductors is lithography, or process node, which refers to transistor dimensions on the chip. The most advanced silicon chips use a 5nm lithography process, supporting upwards of 10 billion transistors per chip, which are required for smart phones and artificial intelligence. However, the widest variety of silicon chips use lithography processes in the range 28nm to 65nm, supporting between 50 million and 1 billion transistors per chip.

The UK’s capability within each semiconductor group can be summarised as follows:

For basic silicon chips, where the lithography exceeds 90nm, the UK has modest R&D, design and fabrication capabilities. For high-end silicon chips, with lithography less than 90nm, the UK has world-leading capabilities but lacks fabrication. For compound semiconductors, the UK has world-leading R&D, design and fabrication capabilities. Lastly, the UK is strong on organic semiconductor R&D, but lacks large volume fabrication.

Industrial support

Following a strategic review of UK semiconductor capabilities from 2013-15, Innovate UK established the Compound Semiconductor Applications Catapult in Newport, South Wales.

The Catapult is a non-profit research and technology organisation (RTO) set up to grow the UK economy by helping companies develop advanced electronic products using compound semiconductors to deliver system level benefits. The Catapult does not develop its own products, but helps other companies develop products by de-risking research and innovation, and building UK supply chains.

Since its inception, the Catapult has initiated over £140m of projects, working closely with UK fabs by incorporating their chips into projects with tier 1 manufacturing companies. In one project supported by Innovate UK, called M-PowerD, the Catapult is working with INEX, a leading gallium nitride (GaN) fab, to develop a low cost, high voltage GaN power transistor for applications in power electronics, machines and drives (PEMD).

In another project called ESCAPE, supported by the Advanced Propulsion Centre (APC), the Catapult is working with CLAS-SIC, a leading silicon carbide (SiC) fab, and McLaren Applied Technologies to produce an end-to-end supply chain for power electronic inverters for the automotive industry.

By applying this model, the Catapult takes a leading role in building resilient UK supply chains, from fab to application.

Author details: DR ANDY G SELLARS, Strategy Director, Compound Semiconductor Applications Catapult