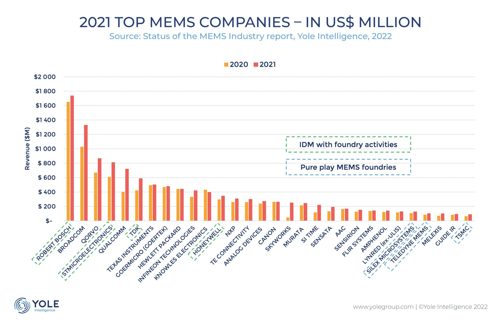

MEMS players’ revenue grew by 17% YoY, up from $11.5bn in 2020 to over $13bn in 2021

Bosch continues to be the biggest supplier of MEMS devices, followed by Broadcom, Qorvo and ST.

In 2021 revenues were driven by the continuous sensorisation of both consumer and automotive applications and by advances in the medical and industrial end markets and associated applications.

The ASPs of some MEMS devices, such as inertial and pressure MEMS, increased slightly in 2021 due to the chip shortage and global allocation problems, creating additional revenue growth in the market.

The top-10 players have not changed significantly in the past couple of years: Bosch, Broadcom, STMicroelectronics, Qorvo, TDK, Goermicro, Texas Instruments, HP, Infineon, Knowles, but there is a growing ‘tail’ of smaller specialized MEMS players who are expected to enjoy growth over the next five years driven by emerging MEMS devices and applications. These include: SiTime, USound, xMEMS, OQmented, and Sensirion, among others.

Of the total revenue, $570 million in 2020 and $690 million in 2021 were generated by players offering foundry services to fabless companies and those IDMs that cannot fulfil 100% of sensor manufacturing internally.

Until a few years ago the top MEMS foundries had little revenue (typically less than $60 million) but now, as new companies increasingly turn to outsourced MEMS manufacturing, MEMS foundries have seen revenues growing strongly. Silex, Teledyne MEMS, and TSMC are part of this segment.

With demand surging, Yole said that MEMS players are currently investing in new production fabs: Bosch, SilTerra, Silan Microelectronics (160kwpy), FormFactor.

Increasing capacity is currently the general trend in the semiconductor space following the chip shortage, and the equipment market is fully saturated with high equipment prices and >15 months’ delivery times.

With the increase in demand being seen Yole Intelligence’s analysts have identified several significant examples of acquisitions and merger activity such as Silex’s acquisition of Elmos’ 200mm wafer line, and Mitsumi acquisition of Omron’s MEMS business.

Bosch has also announced the construction of a 300mm MEMS line that will open in 2026 to consolidate its leading position.

Key drivers and trends within the market, according to Yole, include:

- Continued strong demand for MEMS, with some MEMS foundries’ schedules already filled to end-2023.

- Decreasing margins because of higher operating costs due to the current microeconomic and macroeconomic situation leading to an increase in ASP across some MEMS devices.

- And future inventory over-stocking by integrators stockpiling chips (among them MEMS), potentially leading to a downturn in MEMS players’ activities in 2023