MNOs worldwide built out their pioneering voice and data networks to accommodate low power wide area and low data rate demanding industrial applications, such as machine-to-machine communications (M2M) and the more generic IoT connectivity, but have left a void as their legacy 2G and GPRS networks – the workhorses of those applications and services – are gradually being turned off.

This void is being filled by a growing mix of candidates grouped under the umbrella term LPWAN – low power wide area networks.

Many of these operate in the unlicensed sub-GHz spectrum and fulfil needs in applications and markets as diverse as agriculture, oil-fields, utilities and mining, asset tracking, health monitoring, citywide lighting and energy management. They generally offer the low cost and simplicity necessary to connect scores of sensors and devices that previously could not be interconnected.

But most are based on proprietary technologies and solutions and even more radically diverse business cases. There is a feeling amongst industry observers and the participants themselves that unifying around a single standard could prove difficult, if not impossible.

This uncertainty and fragmentation is clearly holding back early adoption at the scale that would lead to costs coming down – and cost will continue to be as big an issue as the underlying technology; in truth, relatively simple compared to many in the wireless sector.

The LPWANs with the largest market penetration to date are Sigfox and LoRa, with Ingenu (formerly known as On-Ramp) moving quickly in the US. But there are others, including: Symphony, a version of LoRa offered by LinkLabs that uses the LoRa PHY with a custom media access controller; N-Wave; and Weightless-P, the only option that is a true open standard and that targets IoT applications.

Sigfox is interesting in that the French company not only offers the robust technology, but also the network and service, ‘making the proposition the most cost effective low power solution for connecting modules via very simple transceivers’, according to co-founder Christophe Fourtet.

The system operates in the 866 to 915MHz ISM bands and, says Fourtet: “Requires very, very little power or bandwidth and crucially, through a really simple software adjustment, will get users connected to the Internet.”

On the radio side, Sigfox uses a novel ultra-narrow-band modulation technique in the form of binary phase-shift keying optimised for sending short messages only at low data rates.

“We have been meeting our targets and have rolled out networks that now connect billions of devices through the Internet and are present in more than 30 countries and many cities in the US,” Fourtet told New Electronics. “We have also partnered with some global companies and concluded strategic deals with operators such as Telefonica and SK Telecom. With funding from the likes of Samsung, Intel and Total, we plan to become even more aggressive and hope to be present in 60 countries by 2018.”.

Prof William Webb

He added the company now offers simple transceiver modules which include sensor, silicon and software, for as little as $2.

The company says it charges as little as $1 per year for connectivity. “But we are aware there is significant competition, so we are planning to make public the entire specification and protocols used in our technology. We need to ensure that everyone, including companies in China, can deal with us on a NDA basis. Not enough people are aware of our pricing advantage, especially when compared to the cellular options such as NB-IoT (narrow band IoT) and versions of LTE-M that will soon be coming to the market.

“We need to communicate better that these offerings, based on licensed spectrum, are targeted at different applications and, once hardware cost, including the SIM card modules, is taken into account, how cost effective our proposition is.”

One of the biggest considerations for a company choosing to implement either a local or global LPWAN is the standard’s ownership model. Here, Sigfox is seen by some as vulnerable, being the most ‘closed’ system of the various options.

Industry observer and founder of consultancy WiFore Nick Hunn notes: “While the technology is simple and clean – and works – and chips and modules can be obtained from a variety of sources, all traffic is routed through Sigfox’ servers and cloud platform.” This ties the customer to annual running costs. The upside is that the service should be the same everywhere. “The downside is the risk,” warns Hunn.

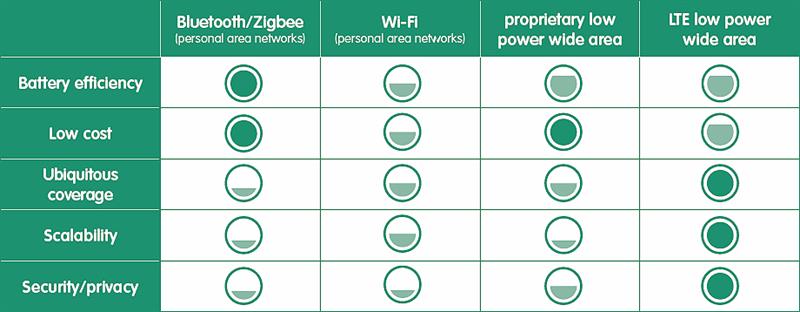

The requirements for IoT wireless connectivity, according to Sequans

Ingenu’s LPWAN business model is close to that of Sigfox, but uses the busy 2.4GHz unlicensed band. At first, this would seem to limit range, but the US focused company deploys a novel coding technique dubbed random-phase multiple access (RPMA), in which direct-sequence spread spectrum and differential BSPK modulation push peak data rates to 634kbit/s and a range generally longer than other LPWAN offerings. The company also claims more users per access point.

Ingenu has IoT networks in more than 30 US cities and its modules are supplied by u-Blox and ODM Compal.

Perhaps the most ‘open’ and compelling LPWAN in the unlicensed group is LoRa (for low-range). This proprietary modulation format is owned by Semtech, whose chips use chirp spread spectrum (CSS) modulation combined with FEC for the PHY. The technology uses the 868MHz band in Europe and 902 to 908MHz in the US.

LoRaWAN is an open standard that defines the communication protocol for the networking technology based on the LoRa chip. It defines the media access control in the data link layer and is maintained by the Semtech inspired LoRa Alliance, which has specified three classes to cover a range of applications, including battery powered sensors, battery powered actuators and mains powered actuators.

Semtech makes the higher-layer protocols available to Alliance members under a royalty-free license basis, but is the sole supplier to date of the silicon and associated IP. “The business model means anyone can acquire a LoRa base station for few hundred pounds and set themselves up as a network – in fact several campuses have,” says Hunn. “The issue is one of scaling up.”

Interestingly, there is a crowdfunding initiative – the Things Network –that has designed numerous modules and gateways and sells them via Farnell/Element 14 in a model similar to that for the Raspberry Pi.

More than 400 companies and groups have joined the LoRa Alliance and are backing LoRaWAN, including some global mobile network operators who are deploying it in conjunction with their cellular low power options. Last September, the Digital Catapult launched a Things Connected initiative that includes BT, Beecham Research, start-up incubators and researchers from universities across London.

The Weightless SIG has also been trying to get market traction for its technology, notably the Weightless-P specification, but the focus has been more on trying to act as a unifying force for the sector.

Professor William Webb, Weightless SIG’s chief executive, told New Electronics: “It is important that there is a viable LPWAN sector that uses the unlicensed spectrum but, for the moment, we see only fragmentation and nothing like the kind of volumes of nodes installed that makes a real business case for any of the incumbents. Figures are really difficult to come by, but my estimate is the three main incumbents (Sigfox, LoRa and Ingenu) have about 10million users installed. We are simply bumping along on the bottom.”

He remains optimistic that, sooner or later, all major players will realise that either a single open standard will have to agreed – perhaps through an initiative by chip suppliers working within an existing standards body – or by one of the existing technologies opening its spec and merging with another. The chances of this happening, says Prof Webb, are about 50:50.

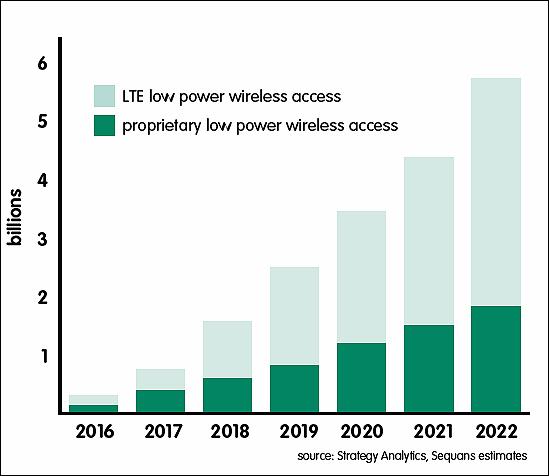

Demand for low power wireless access is predicted to grow significantly in the next five years

Weightless itself tried to get things moving in the right direction earlier this year when it transferred its open standards into the ETSI standards setting organisation, which has an informal sub-group for developing a family of standards for Low Throughput Networks. “Unfortunately, it has become apparent that this approach would not even be a short term fix,” Prof Webb noted. “I am disappointed, of course, but it was always a long shot and not our only plan. We will continue our efforts for consolidation.”

If unlicensed groups do not step up to the mark, this will let the traditional MNOs, with their established cellular networks and licensed spectrum, back into the game.

While they may have taken their eyes off the ball a few years back, recent efforts within the 3GPP standardisation group suggest a resurgence, with more cost effective standards and revised business models, is well under way. Network operators can now offer two options, both of which can be incorporated via software upgrades to their LTE networks. LTE-M and NB-IoT were ratified in June 2016 by 3GPP as part of Release 13, since when there have been trials and implementations in Europe, the US and Asia.

In the US, most operator activity, by the likes of Verizon and AT&T, has focused on LTE-M; European carriers, notably Vodafone, seem wedded to NB-IoT.

“The two versions will co-exist. It is hard to see which would dominate,” said Georges Karam (left), CEO of French SoC specialist Sequans, which makes devices for both versions. Sequans also claims its Monarch chipset is ahead of the competition in terms of design-ins, but volume shipments are not expected until at least next year, suggesting serious deployments are still some way off.

Those competitors include Qualcomm, Altair (now owned by Sony) and Intel, with ARM recently entering the fray for a slice of the IP business, notably in NB-IoT, through the acquisition of Swedish group Mistbase and UK based NextG-Com.

One reason why NB-IoT has been slower to take off than anticipated is alleged incompatibility with equipment from Chinese group Huawei and Ericsson, following disputes over IP, essentially leading to two different versions of the standard. The companies have denied this, as have the standards setters.

The feeling is that LTE-M will prevail in the short term, especially as the US continues to bar Huawei gear from entering the country, but that NB-IoT could prove to be a more cost effective approach for cellular IoT.

As to which class of LPWANs will prevail, the jury is certainly out. There is clearly a serious cost premium when it comes to the modules needed for cellular, perhaps not as big as proponents of systems based on unlicensed spectrum may suggest, but LTE and NB-IoT are clearly more secure – and can piggy-back on existing network infrastructure.