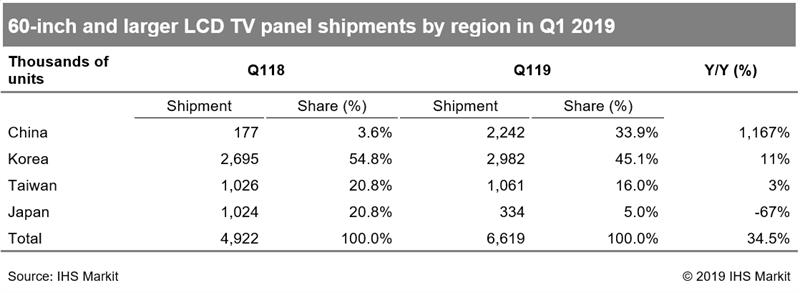

With Chinese panel makers accelerating the mass production of large thin-film transistor (TFT) liquid crystal display (LCD) TV panels faster than expected, they accounted for 33.9 per cent of the 60-inch and larger LCD TV panel shipments in the first quarter of 2019.

South Korean panel makers still accounted for the largest share in the 60-inch and larger LCD TV panel shipments, with a 45.1 per cent share in the first quarter. However, Chinese panel makers’ share in the large LCD TV panel market is expected to continue to grow.

“When BOE’s B9 10.5G fab started its mass production in the first quarter of 2018, the industry expected that its full ramp-up would take quite a time due to a learning curve,” said Robin Wu, principal analyst at IHS Markit. “However, it did not take as long and BOE has become the largest supplier of 60-inch and larger LCD TV panels since the end of 2018.”

BOE accounted for 29 per cent of the total 60-inch and larger LCD TV panel shipments in the first quarter of 2019, according to IHS. It is estimated that the B9 10.5G fab has reached its maximum capacity of 120,000 sheets in the first quarter of 2019.

ChinaStar also started to mass produce large LCD panels at its T6 10.5G fab in the first quarter, adds IHS. CEC-Panda and CHOT ramped up mass production at their 8.6G fabs to the maximum design capacity in the first quarter. Foxconn/Sharp is forecast to begin mass production at their Guangzhou 10.5G fab in the second half of 2019.

“As both Chinese and South Korean panel suppliers are focusing on large LCD TV panels, competition between them will become more intense, pressuring the price of large LCD TV panels even further throughout 2019,” Wu said.

According to the Large Area Display Market Tracker by IHS Markit, shipments of larger than 9-inch TFT-LCD panels reached 178.3 million units in the first quarter of 2019, down 1 per cent from a year ago. By area, the shipment increased by 6.7 per cent to 49.1m square meters during the same period.

BOE led the unit shipments of large TFT-LCD panels with a 24.6 per cent share in the first quarter of 2019, followed by LG Display (18.8 per cent) and Innolux (16 per cent). By area shipments, LG Display accounted for the largest share of 20 per cent, followed by BOE (19.9 per cent) and Samsung Display (14.1 per cent).