Since its introduction, blockchain technology has created a tremendous buzz, offering a secure exchange of value without any need for a central authority such as a bank, government or a financial institution. As such, some consider it as an essential tool for building trust online and expect it to serve as a stable foundation for a fair, secure, and inclusive digital economy.

Consequently, blockchain has captured the attention of many, with Governments, enterprises, academic institutions, and the ever-growing blockchain community in talks on what this innovative technology can offer to society.

In fact, Europe has taken active measures to support the innovation of platforms and applications in the form of number of initiatives, such as the European Union Blockchain Observatory and Forum.

According to market research published by ReportBuyer, the global blockchain business is anticipated to be worth $7billion by 2022, and judging from the investments being made by tech giants such as IBM and Facebook, this could well be an accurate prediction.

But despite being a ‘hot topic’, blockchain is yet to be widely implemented in anything other than for the purpose of cryptocurrency.

What is blockchain?

Initially created for bitcoin – a type of cryptocurrency – blockchain acts as a trusted way to record transactions of a crypto asset. In other words, it acts like a traditional financial ledger, but instead stores information in digital blocks which are connected by a continuous chain.

Every transaction is a block, which is then added to this chain, explains Chakib Bouda, VP and CTO, Payments, Rambus. "Every transaction is incorporated into a block of transactions, which is then added to this chain. The blocks store data associated with a public key and keeps track of who owns what, i.e. person ‘X’ has spent 0.1 bitcoin and person ‘Y’ has received 2.5 bitcoin.

“Let’s say that I wanted to transfer 1 bitcoin to person X,” says Bouda. “When I request to put something on or take something off the blockchain, I’m given a private key, which I’ll need to use to sign the new block.”

The blockchain is decentralised and distributed across a large, public network of computers that act as nodes, with an ecosystem of ‘miners’ around it.

“A new block goes to all of the miners, who will ‘fight’ to validate it,” he explains, a process known as ‘proof-of-work’. This validation comes in the form of a mathematical equation, which is increasing in difficulty over time as bitcoin is ‘mined’.

“Whoever ‘wins’ gets rewarded with bitcoin,” continues Bouda, “and my block would then be added to the chain, with the information that my 1 bitcoin now belongs to person X. This updated ledger is then sent to everyone in the network.”

Bouda compares the mining process to an in-store transaction. The card machine sends information to the bank, which validates it. But, the bank is centralised, meaning there’s only one point of entry for those trying to access funds. In the blockchain environment, the miners act as the bank, but there’s millions of them, based in scattered geographies.

This proof-of-work system means that each block can be trusted as ‘the digital truth’ because the ledger is immutable. For this reason, a lot of companies see blockchain as a potential tool for tracking the lifecycle of a product or for storing data such as housing ownership.

If someone did manage to tamper with the data, it would be obvious. “Each block contains a hash that matches it to the previous block,” says Damon Neale, Cloud storage expert. Created with an algorithm, the hash turns numbers and letters into an encrypted output. “If someone hacked a block, the hash would be altered and it would be obvious they’d tried to access it. This means a hacker would need to attack the entire chain, but that’s pretty much impossible because the system is decentralised, with every user having a copy of the chain. This means a hacked chain could be compared to a previous copy, and again, it would be obvious a breach had been attempted.

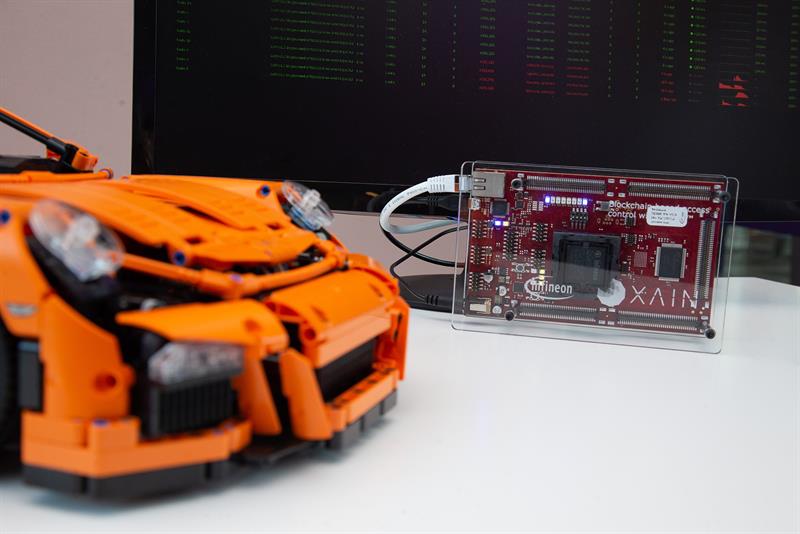

| Infineon and XAIN collaborate on bringing blockchain to the car |

“The only way to truly hack the chain is to hack every machine – a number in the thousands – and because it’s a distributed system, a hacker wouldn’t know where all these machines were based. Moreover, in the time you’re hacking, new blocks can be added.

“It’s not impossible,” he admits, “but it’s very hard. Whereas with a bank, if a hacker got past the security, the assets are all in one central point.”

A different approach

Although many regard the proof-of-work as one of the defining features of the blockchain, interestingly, Doug Wick, VP, Products and Marketing at data security company, ALTR, believes this quality should be associated with the crypto world solely. “Blockchain is a particular way to structure and save data so as to give it high integrity and security.

“To me, the proof-of-work system is how a public blockchain works,” Wick suggests. He explains that ALTR has taken a different approach, creating individual businesses a private and permissioned blockchain instead. “In this case you don’t need to carry out a proof-of-work because you know that all of the nodes can be trusted, where they’re operated from, and who’s running them.”

Companies are, however, working on different ways to validate. The reason being is because the current proof-of-work method requires an extremely powerful computing system and it takes a long time for transactions to be added to the network. It has been argued that such a solution is not practical for other applications because it’s not scalable and when data is required, it’s needed in real time.

| “As blockchain progresses, I can see data centres becoming part of the distributed, decentralised network. Power will go back to the people.” Chakib Bouda |

To create a secure data storage system, ALTR has made some significant changes from the traditional blockchain. This includes schema-less blocks, meaning that information such as documents, images, and videos can be stored. The company has also made the blockchain itself centralised, so there is no public access. “Hospitals wouldn’t want patient information shared publically,” Wick reasons. “What is decentralised is the data structure. Our technology is built in a such a way that we can deploy nodes anywhere, but still privately. For example, a company might have some data stored in Amazon Web Services, some in Microsoft Azure, and some in its own data centre. It’s fragmented, so that no node contains the complete data, but each has a reference to the previous piece, meaning that ALTR can reassemble it when required.”

ALTR treats the blockchain like a RAID array, a technology that works with an array of separated hard drives that are controlled centrally. These work by replicating data across all of the hard drives, so if one goes down, the others still have access. RAID arrays also enable simultaneous writing to different harddrives, allowing for better performance. “We have built our technology around this concept,” says Wick, “giving the ability to read and write rapidly out of the blockchain.”

When an application wants data it ‘asks’ the smart database driver, a technology used in every database system. ALTR connects into existing computing networks through this driver, and has designed a technology that enables its blockchain to sit between this driver and the application. According to Wick, this means ALTR can monitor data activity. “Using the blockchain, we create an immutable data log that represents the digital truth. We can also govern access, so if a certain group requires access we can attribute rules to the block, such as viewing limitations. If someone tries to obtain an abnormally large amount of data, it would be flagged up and we can stop or slow that breach down in real time.”

Beyond cryptocurrency

Both Wick and Bouda agree that there are many applications that would benefit from blockchain technology. One notable use case has recently emerged, with Infineon and XAIN agreeing to bring blockchain to the car.

According to the duo, feasible applications for this technology include automated payments, keyless access for car sharing schemes, on-demand services, tuning protection and automated driving functions. Essentially, it is all about the granting of access rights – to the car itself or to specific data in the vehicle. An example involving specific data is when insurance companies offer low rates for car owners with good driving habits.

All of Infineon’s 2nd generation AURIX microcontrollers (MCUs) can provide support for blockchain functionality in cars already. This support is based on an embedded hardware security module (HSM) that complies with the EVITA security standard. An HSM consists of special computing and storage units within the MCU. It performs the cryptographic operations and is protected by a dedicated firewall of its own. The 2nd generation AURIX MCUs thus have a secured memory for the digital key used for identification in the blockchain and are able to perform blockchain operations, such as hashing or digital signing, swiftly and securely.

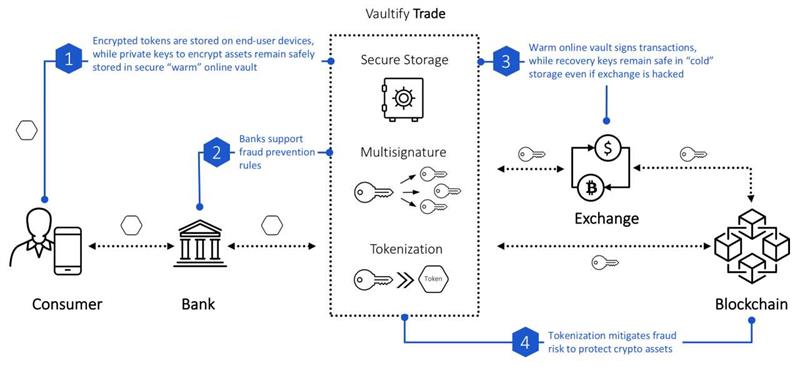

| Rambus has launched Vaultify Trade that enables secure storage and transfer of digital assets using proven, bank-grade, field-deployed tokenisation and encryption technology |

However, the creation of new data blocks still represents a challenge for the conventional MCUs used in cars. Due to the amount of required computing power, the mining process has up till now been executed by high-performance processors. XAIN, however, is working on a new process that can also be performed on devices that need to be economical in their use of energy – such as MCUs in cars.

What’s next?

As for the future of blockchain, Bouda sees decentralisation as the way forward. “There is ‘talk’ of a decentralised Internet,” he says, pointing to data misuse from Internet based companies as a key driver for this development. “It sounds impossible, but I do see it as a potential. Not everything will be decentralised, but user content could certainly be – and this would place the power back with the people. Organisations earn millions selling data to ad companies, but with this a system like this, they’d have to start asking permission to access our data.

“Data centres won’t become redundant,” he ventures, “but instead of being central, they’ll be spread across points. Big players like Amazon and Google would become part of the network. I can’t imagine the idea is appealing to them, but there’s a mentality of ‘if you can’t beat them, join them’.”

“Everyone is very excited about blockchain, but no one has really adopted it,” adds Neale, “and that’s due to a lack of understanding of the benefits. When companies do deploy it, it’s being used as a less distributed, more centralised blockchain, which kind of defeats the point because there are fewer nodes to hack to compromise data. One could argue it’s just an overly complicated database. There’s a lot of potential, but for now, I’m not seeing it being used for anything but cryptocurrency.”

Bouda admits that blockchain isn’t as scalable as industry would like it to be, but compares it to the beginnings of the Internet. “That was slow – and this too, will take time.”

Wick believes that blockchain’s sluggish uptake may be due to the association of bitcoin. “This was a global phenomena and when companies look to utilise blockchain, they think really big. But this technology is still so new and extremely complex, so what we need companies to do is start solving the little problems and get people used to the technology.”

Wick says ALTR has taken this approach, solving a smaller problem: digital trust inside individual companies. From there, he believes trust can be built with the public in the blockchain. “Let’s say we have a group of banks using our technology, from there we can introduce a consortium-based blockchain where the banks can use a shared chain for transactions or to record activity with one another. Because they trusted it inside their own company, they have now developed trust to use it within the industry. Industry needs to build up and up, and then we’ll slowly start to see, for example, blockchains that are shared by nations or an entire supply chain.”