When it comes to emerging technologies, the test and measurement industry has to be the frontrunner for the simple reason that you can’t evaluate the functionality of something without the ability to test it. Over the past year, discussions have been dominated by the topic of 5G. That once high-level topic is becoming more nuanced as the simpler questions are answered by the initial roll out.

The different phases of 5G mean that test and measurement devices need to be adaptable and scalable as new functionalities become available. “Like previous generations, 5G will roll out not just as a longer-term network build-out paced by policies and network operator capex plans, but also by the evolution of the standard,” commented Roger Nichols, 5G Program Manager, Keysight Technologies. “Therefore, 5G-specific network testing is an ongoing process with phases dictated by the rollout of features based on new releases of the standard.”

One issue for network operators is that they need to be able to test products and devices that don’t yet exist. For this reason, National Instruments (NI) has developed test user equipment that emulates a 5G handset. Sarah Yost, Senior Product Marketing Manager at NI explained: “We're still pretty early in the game, so a lot of updates are still being made on the software side for base stations and other equipment even if some of the hardware has been initially deployed. [Test user equipment can provide] a golden reference to run against the base stations to make sure the equipment is working.”

Yost added that this need for user test equipment is driven by 5G’s inherent densification disrupting the base station ecosystem. Mobile network operators are still deploying their own base stations, but small cells are becoming increasingly widespread. As such, there is more demand for base station equipment, but these small cells do not have access to the same resources.

“The big traditional players like Nokia, Ericsson, Samsung and Huawei get support from semiconductor chipset makers. Companies like Qualcomm create MTPs – mobile test platforms – that can be connected to the base station and provide diagnostic information, such as throughput, across the different communication layers,” said Yost.

The issue is that those MTPs are not widely available or particularly user-friendly, so small cells can have difficulty procuring user test equipment to validate their network. Yost added that “once we start looking at applications like industrial IoT, we’ll start to see more demand for private networks so there can be certain guarantees of quality of service. That means we’ll see a little microcell deployed for factory, for example, and that brings a whole new level of complexity.”

Going beyond cable testing

To deliver widespread coverage and support all use cases, 5G will use spectrum within three key frequency ranges. One of these, mmWave, has not previously been used for mobile broadband, and whilst it is not new to the test and measurement industry, it has created a new requirement for beamforming. Frank Groeger, Director of Technology Management at Rohde & Schwarz said, “if you use higher frequencies, you also have a higher path loss. That means it is necessary to apply beamforming to direct the waves to the user and that can be done with the use of antenna rays. This means that you cannot test by a cable connection like in the past, now you have to test over-the-air.”

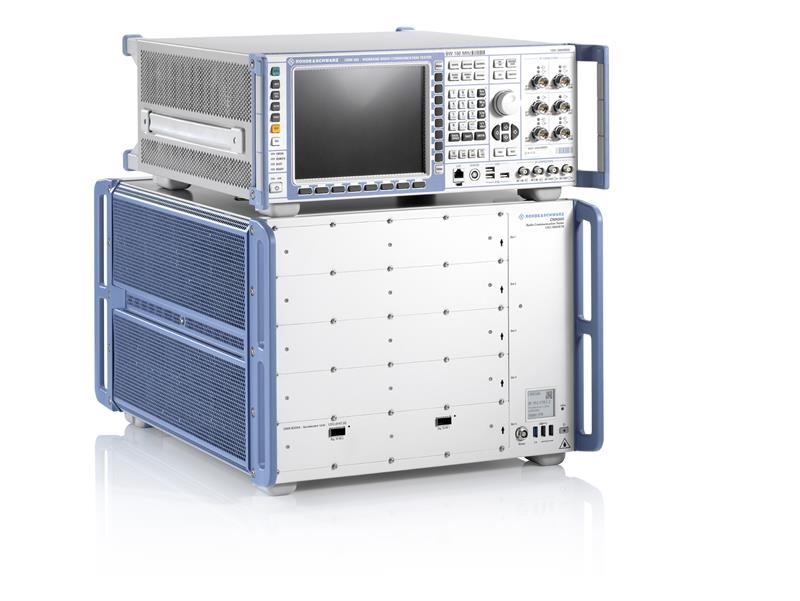

Below: The Rohde & Schwarz CMX500 Radio Communication Tester freatures a modular and scalable HW-Architecture. It is able to complete a 5G NR signalling test in sub-6 GHz (FR1) and mmWave (FR2) frequency bands.

Alejandro Buritica, Senior Solutions Marketing Manager at NI, explained why existing mmWave development was not necessarily helpful for the 5G era. “A lot of existing mmWave test equipment was developed for other industries like satellite communications, radar, military or aerospace – so it's got a pretty steep price tag.” He added that having to test over-the-air brings with it “intricacies and difficulties” such as having to “keep track of the [path] losses”. Test engineers and designers also need to “calibrate the fixtures and distances to be able to guarantee the measurement quality of these devices”.

The rise of 5G is also changing traditional test equipment set-ups. Groeger explained that because test equipment often needs a higher accuracy than the system being tested, the computing power you need could be enormous. He said, “Test equipment [should be] tailored to a specific test task and in some cases ultra-high performance is needed. In those instances, you’ll need dedicated and tailored hardware.”

Keysight Technologies’ Nichols added, “While the dedicated application-specific test controller is a thing of the past, we still provide a variety of approaches. These range from stand-alone test products, like an RF network analyser, in which embedded PCs run applications to provide added insight to the information gained from the measurements; to complex systems with multiple racks of measurement equipment.” The company also offers set-ups that integrate with cloud-based systems as these are needed with Industry 4.0 set-ups.

Understanding test results

This additional complexity calls for new techniques to make test results understandable. Vikas Chauhan, Director, Business Development for EMEA Wireless Business at Anritsu, said, “The focus of test results is not just limited to the detail and accuracy of the information provided, but also to how understandable they are. There needs to be complete information, but in addition some users will need a simpler view so they can quickly and easily debug and evaluate the test failures. The view should be customisable to provide the level of detail needed.” Chauhan added that Anritsu’s test logs can be filtered to various levels of detail and can be exported in generic formats such as HTML or CSV, so users can further analyse the data in a format they need.

This chimes with the view of Nichols. He said, “Providing insights to our customers is one of our most important tasks. We ensure that measurements are traceable to primary standards [and] most of our measurement equipment has software applications that provide multiple ways to view the measurement results, which enable insight.” Nichols added that the company is also “using data analytics and artificial intelligence to help customers make more sense of large quantities of measurement data”.

Future requirements

The real gamer changer for the test and measurement industry will be in a few years’ time when market growth brings costs down.

According to NI’s Yost, “from the massive IoT standpoint, I think the most challenging thing is hitting the price point that the market demands. 4G and connected devices have bought down the cost of wireless sensors. But if you think about setting up a smart factory, there will be hundreds of nodes in a single factory, so you don't want those nodes costing more than five or ten dollars. There's this big push to bring the cost point down of not only the wireless chipset itself, but also the testing of that chipset.”

These vertical applications of 5G are where the standard will make the most difference. Anritsu’s Chauhan said, “In truth, the key 5G evolution is about enabling the industry verticals. The automotive industry will be able to achieve more autonomous driving capabilities through car-to-car communications, and smart manufacturing will be made possible through the availability of private 5G networks. There will also be new possibilities in agriculture, for the medical industry, as well as within utilities and transport. 5G will become a core part of our life by meeting the needs of these industry verticals.”