Senior Analyst at DRAMeXchange, Mark Liu says that upon analysing the market, worldwide server growth momentum in 2018 mainly derived from North American brands, which comprised over 30% of total shipments.

Category-wise, he says that enterprise servers still form the largest shipment group, while the share of shipments toward internet data centres is growing year by year, from 35% in 2018 to 40% in 2019.

The analyst adds that as 5G begins to transform businesses, telecommunications companies and internet providers will increase in their demand for servers. Predictions are that server shipments will peak in 2020.

Looking back at the first season this year, data centre demand was relatively unaffected by the traditional offseason, as total shipments continued to experience stable growth, says DRAMeXchange. ODM direct business shipments grew by 1.3% compared to the previous season. As orders continue to arrive in the second season, seasonal growth of around 1%-3% may still happen, bringing market shares up to 26.6%.

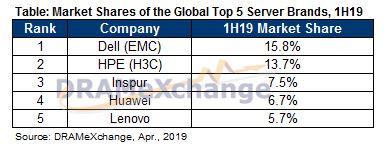

Brands were hit by the offseason in the first quarter, DRAMeXchange adds, with their shipments falling by over 20% compared to last quarter, but the market made a notable recovery entering the second. Looking at the global market share rankings of server brand manufacturer in 2H19, the analyst company says it sees Dell EMC, HPE (including H3C) and Inspur taking the top three spots, with market shares of 15.8%, 13.7% and 7.5%, respectively.

The organisation adds that China's top cloud service providers will drop by about 15% YoY in server purchases this year, while North American companies will be less affected, their purchases projected to keep growing by 5%-10%. As for second-tier companies such as China's Bytedance and North America's NetApp, DRAMeXchange foresees this year's server purchases growing by more than 40% compared to last year, thanks to overseas business development and self-built data centres contributing to demand.