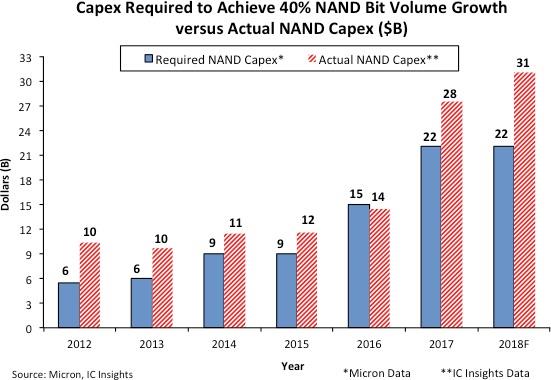

Figure 1 compares the estimated required capex needed to increase NAND flash bit volume shipments 40% per year, sourced from a chart from Micron’s 2018 Analyst and Investor Event in May of this year, versus the annual capex targeting the NAND flash market segment using IC Insights’ data.

The industry capex needed to increase NAND flash bit volume production by 40% more than doubled from $9billion in 2015 to $22bn in 2017, says IC Insights.

It believes the surge in required capital is driven by the move to 3D NAND from planar NAND, since 3D NAND requires more fab equipment and additional cleanroom space to process the extra layers of the device as compared to planar NAND.

Most of the five major NAND flash suppliers predict that NAND bit volume demand growth will average about 40% annually over the next few years.

| Above: Figure 1 |

Figure 1 shows that the capex needed to support a 40% increase in NAND bit volume shipments was exceeded by 27% last year and is forecast to exceed the amount needed by another 41% this year.

As a result, NAND flash prices have already softened in early 2018, says IC Insights, and the pace of the softening is expected to pick up in the second half of this year and continue into the next.

Historical precedent in the memory market shows that too much spending usually leads to overcapacity and subsequent pricing weakness, IC Insights warns.

With Samsung, SK Hynix, Micron, Intel, Toshiba/Western Digital/SanDisk, and XMC/Yangtze River Storage Technology all planning to ramp up 3D NAND flash capacity over the next couple of years – with additional new Chinese producers possibly entering the market – IC Insights believes that the risk for significantly overshooting 3D NAND flash market demand is high – and it’s growing.