Most of the entrepreneurs who approach Mercia, an investment group that looks to identify and then fund and help scale innovative businesses with high growth potential, have conducted basic research into their market and competitors, but have failed to consider six vital questions that make a business plan stronger and more attractive to potential investors. These six questions give entrepreneurs a clearer idea of whether their technology is likely to be adopted and, if so, how long this could take:

1. Does your new device require a change in behaviour?

A new technology requiring a customer to change behaviour could delay time-to-market. While change is often good, especially when it leads to efficiencies, there may be resistance within management and on the shop floor for manufacturing-related technology.

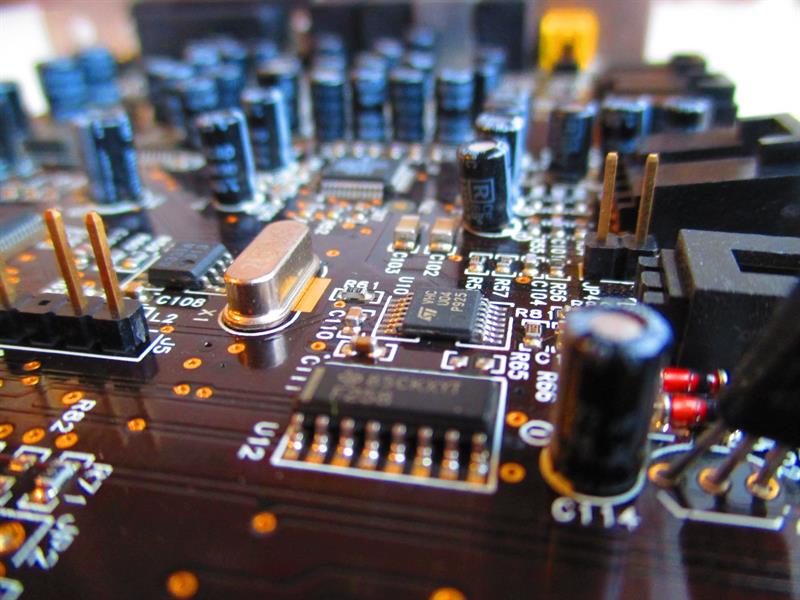

For example, a start-up with an innovative measurement tool was engaged with a global electronics company which was looking to increase productivity. However, the start-up had not initially considered the level of consultancy and training required to bring any workforce using the tool up to speed. In the start-up’s lab, the highly-trained R&D team were able to make the tool work without issue. Conditions on the manufacturing shop floor were very different.

The entrepreneurial team hadn’t anticipated the challenges arising from the language (Cantonese) and the skill level of operatives within a key target market (China). Operatives were also concerned that the introduction of the tool would ultimately lead to reductions in the workforce, and so some were hesitant to adopt it. To resolve this, the start-up business needed to factor in more time to address the concerns and convince all stakeholders of the device’s benefits.

2. Will your hardware innovation require a systemic change?

New technology often needs to be integrated into larger existing systems. We frequently review business plans centred on devices which would enhance the efficiency of diesel engines, motors and even wind turbines. These devices often require some modifications to the installed equipment, which in turn leads to concerns around warranties and aftercare. The economic benefits from the innovation are often not enough to overcome the potential increase in liability.

When this is the case, the team needs to rework its business plan, factoring in additional costs and time for integrating the device into existing equipment and getting buy-in from the manufacturers.

3.How long will it take to bring a product to market in your target sector?

Every hardware industry has a design cycle which can vary widely in length. Start-up founders need to account for this in their business plans. For example, the design cycle for the aerospace industry is measured in decades, whereas the consumer electronics sector releases new devices in just months. Some design cycles are surprisingly long. For consumer home appliances it is around four years.

Entrepreneurs need to show that they are aware of these timescales and recognise that little can be done to change them. For industries with protracted design cycles, we recommend structuring agreements with potential customers which will generate cash before volume sales begin. These can take the form of development agreements or funded testing. All industries are looking for new technologies, but be prepared for a long qualification process as your customers buy samples and test multiple times.

4. Do you know the different risk appetites for all gatekeepers in the buying process?

You will need to understand the risk appetite of various gatekeepers you may face. For instance, quality control teams tend to be conservative and take low levels of risk, while design teams are more open to innovation and new ideas.

We recommend that you map out the various gatekeepers within your customers’ organisations. Be particularly mindful of procurement teams within larger customer organisations, which may attempt to hold your company to terms which are unsuitable or overly burdensome for small businesses. Early buy-in from senior management within the prospective client can help to circumvent any unrealistic or tough procurement requirements.

5. Is the evaluation kit buyer the target purchaser?

Multinational companies may purchase evaluation kits early on – generating genuine excitement within your company. But this may not necessarily turn into a large follow-on order. Start-ups should understand that engineers like “shiny things”, and part of their job will be to buy and test devices which appear innovative. Sadly, an evaluation kit purchase does not give a strong indication of whether a company will buy more units. The purchase shouldn’t be given undue weight in business plan projections, unless you have established a concrete connection between the evaluation kit purchaser and the ultimate buyer.

When selling to large corporations where a technology evaluator (e.g. a central R&D facility) may not have strong links with your targeted business area, a multi-pronged approach is advisable. You should identify the ultimate purchaser(s) and build a relationship with them almost as if they were a separate entity.

6. Who will really benefit from your product?

Some start-up teams approach us without a clear understanding of who will really benefit from their technology. This is a problem when the buyer and the benefactor are different.

For instance, we see a number of companies pitching technologies that make buildings more energy efficient. The cost of these

products and their installation may fall on the building owner, but the benefit of reduced utilities goes to the buildings’ tenants. In this case, it can be difficult to convince the owner to spend money unless there is some recognition or payback. It may be easy to prove the overall benefits of your technology,

but you must be ready to work across the spectrum of stakeholders to ensure

that the value is recognised appropriately.

Simply removing inefficiencies in a system is often not enough. Business models between stakeholders sometimes need to change in order for better technologies or processes to be adopted.

A hardware success story Mobile payments unicorn, Square, is a prime example of a hardware success story. Co-founded by Twitter’s Jack Dorsey, it provides smaller and mid-sized retailers with the ability to process payments easily. Adoption of Square technology has been simple for both retailers and customers. Installation of Square hardware requires absolutely no behavioural or systemic changes, an important point which is so often overlooked and will cause a product launch to fail. In the case of Square, the hardware plugs directly into smart-phones or tablets via a headphone jack which couldn’t be any simpler. Further reasons for success include the targeting of the SME retail market, which is fast at adopting new technologies, and offers few gatekeepers. The company has raised $150 million at a $6 billion valuation, has an international user base, and a strong technology portfolio including its first product, the Square reader to the Square terminal launched in October 2018. |

Author details:

Bill Yost is Investment Manager in Mercia Technologies’ Electronics, Materials, Manufacturing & Engineering Investment team